Why choose Fidelity

Fidelity, one of the largest stockbrokers in the US, offers commission-free stock and ETF trading.

The broker has an excellent product selection and provides a large variety of tools to support your investment research. It has a great web trading platform, which makes it a good choice for beginners as well.

However, opening an account can take a bit longer compared to some of its close competitors. Among other drawbacks, some mutual funds have high fees and margin trading is somewhat on the expensive side.

- Commission-free US stocks and ETFs

- Great trading platforms and research

- US and international stocks

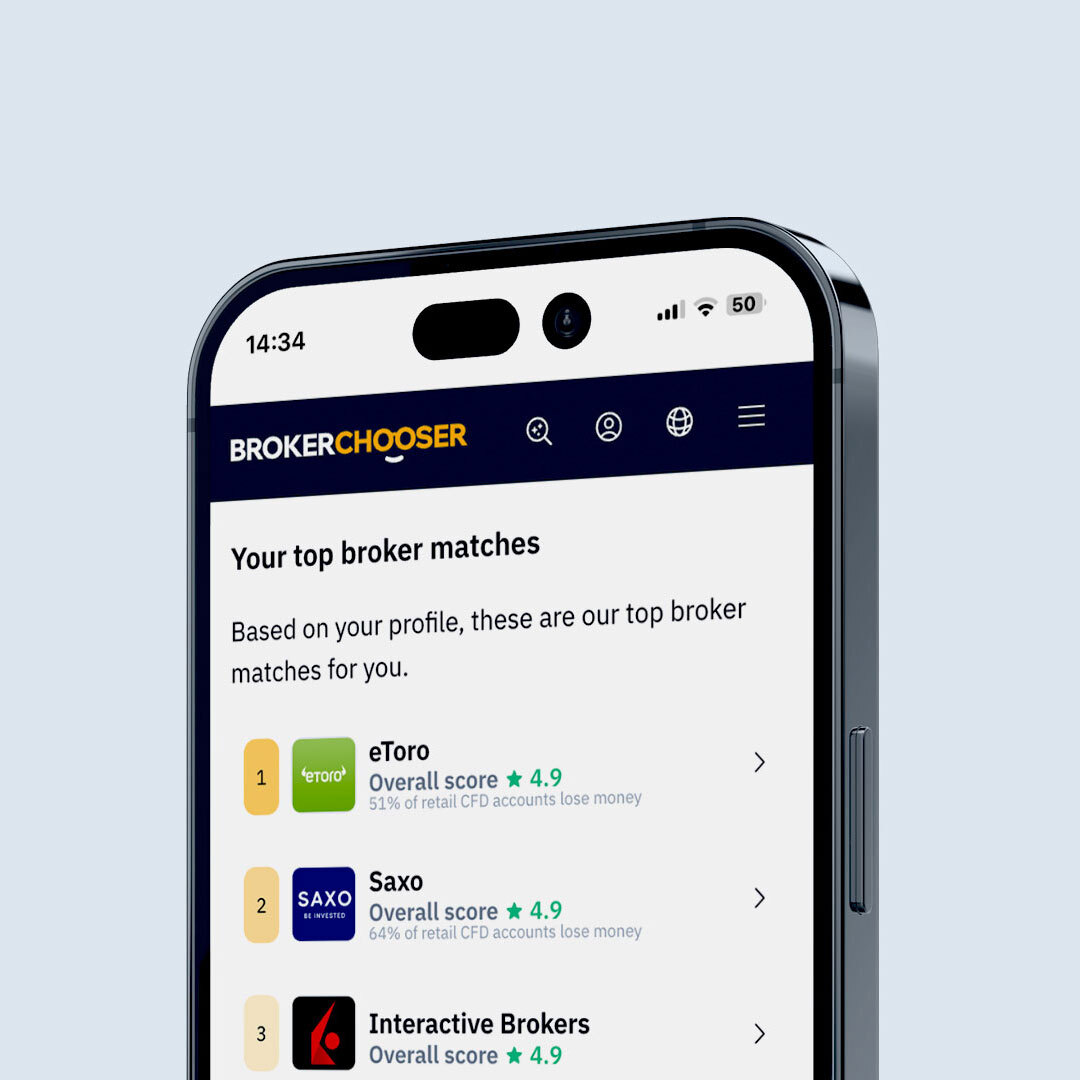

Not sure if this is the right broker for you? See the best ones.

See how the best brokers compare to Fidelity

Fees

- Free stock and ETF trading

- Low bond fees

- No inactivity fee

We compared Fidelity's fees with two similar brokers we selected, E*TRADE and Charles Schwab. These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. See a more detailed comparison of Fidelity alternatives.

Commission-free stock and ETFs

It’s extremely great as Fidelity has commission-free US stock trading.

| Broker | US stock |

|---|---|

| Fidelity | $0.0 |

| E*TRADE | $0.0 |

| Charles Schwab | $0.0 |

This is the case when you trade US stocks. On the other hand, international stock trade fees are relatively high. Still, it is not common for US brokers to offer non-US stocks at all.

There is also a small charge on sell orders, as they are subject to an activity assessment fee of $0.01-$0.03 per $1,000 of principal.

High margin rates

Fidelity USD margin rate fees are higher than the industry average. USD margin rate fees are calculated as follows: Base rate + tiered markup. Markup is +1.25% for balance of 0-25k.

| Broker | USD margin rate |

|---|---|

| Fidelity | 12.8% |

| E*TRADE | 13.5% |

| Charles Schwab | 12.8% |

Low options commission

Fidelity US stock index options fees are about half of the industry average. US stock index options fees are calculated as follows: $0.65 fee per contract

| Broker | US stock index options |

|---|---|

| Fidelity | $6.5 |

| E*TRADE | $6.5 |

| Charles Schwab | $6.5 |

They cost $0.65 per contract.

No inactivity fee, no withdrawal fee

There are no inactivity or account fees. There are also no withdrawal fees for ACH and USD wire withdrawals. Non-USD wire withdrawals however cost 3% of the amount you withdraw. In our review, we tested an electronic (ACH) withdrawal, which worked without any problem.

| Broker | Inactivity fee | Withdrawal fee |

|---|---|---|

| Fidelity | $0 | |

| E*TRADE | $0 | |

| Charles Schwab | $0 |

In addition, there is a currency conversion fee if you trade an international stock that is denominated in a currency other than your account's currency. The currency conversion fee depends on the amount you trade.

| Amount you trade | Cost (% of the traded amount) |

|---|---|

| Less than $100k | 1.00% |

| $100k - <$250k | 0.75% |

| $250k - <$500k | 0.50% |

| $500k - <$1 million | 0.35% |

| Above $1 million | 0-0.20% |

Other commissions and fees

High mutual fund commission: trading mutual funds involves the following charges - $49.95 or $75 for buying while selling is free; some 3,600 free mutual funds.

High spot crypto fees: at Fidelity, crypto trading costs 1% of trade value.

Low bond commission: US treasury bonds come with the following charges - $0 for Treasury bonds, and $1 per bond with a $250 max for other bonds.

| Broker | Mutual fund | US micro e-mini stock index futures |

|---|---|---|

| Fidelity | $37.5 | - |

| E*TRADE | $0.0 | $15.0 |

| Charles Schwab | $25.0 | $22.5 |

Check out a detailed analysis of all the fees, commissions, and other charges levied by Fidelity for more information.

Safety

- Majority of clients belong to a top-tier financial authority

- High level of investor protection

- Additional coverage by Fidelity

Deposit and withdrawal

- Free withdrawal

- No deposit fee

- Several account base currencies

Account opening

- No minimum deposit

- User-friendly

- Many account types

Mobile app

- User-friendly

- Good search function

- Good variety of order types

Desktop platform

- Clear fee report

- Good customizability (for charts, workspace)

- Good variety of order types

Product selection

FAQ

Everything you find on BrokerChooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology.