Why choose Zerodha

Zerodha is among the largest discount brokers in India with a wide range of products and free equity delivery. It is a good choice for beginner investors because of its easy-to-use trading platforms.

As a drawback, Zerodha is only available to Indian residents, it covers only the Indian market, and it takes quite a long time and some actual paperwork to open an account.

- Low fees

- Great trading platforms

- Solid research

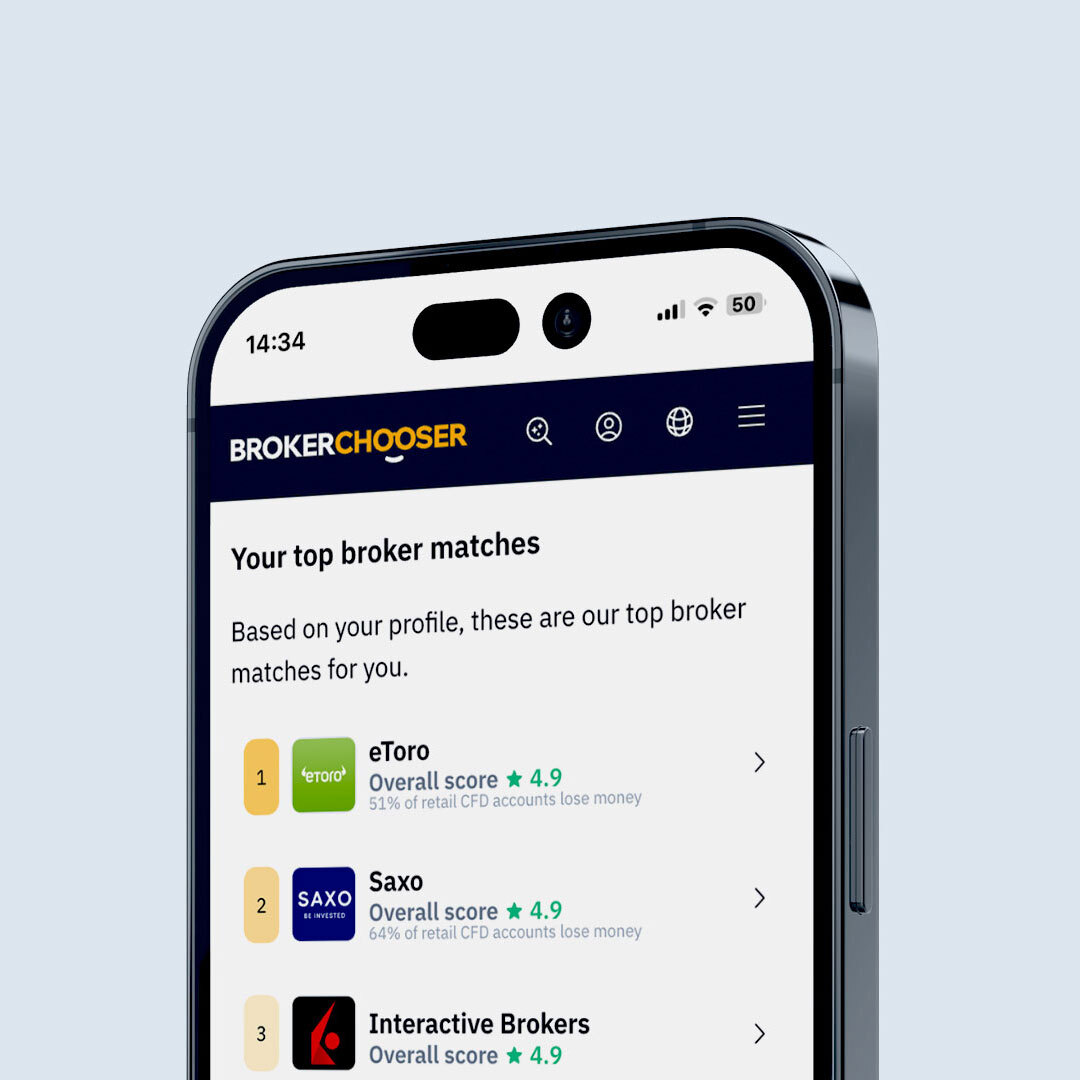

Not sure if this is the right broker for you? See the best ones.

See how the best brokers compare to Zerodha

Fees

- Low trading fees

- Low non-trading fees

- Low stock and ETF fees / Free stock trading

We compared Zerodha's fees with two similar brokers we selected, Sharekhan and Interactive Brokers. These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. See a more detailed comparison of Zerodha alternatives.

For equity delivery, it doesn't charge any commission.There is exceptionally transparent information on fees on Zerodha's website, supplemented by an easy-to-use fee calculator. As other charges may apply, we have put together a table featuring catch-all costs.

Indian stock fees and FX fees

Given that Indian brokers usually offer only a few types of products, we compared the brokers by calculating all the fees of a typical trade for two assets.

We chose the following assets:

- Reliance, a large-cap Indian stock

- USDINR, a popular currency pair

We compared the fees for an equity delivery trading for Reliance and a currency futures trade for USDINR. In both cases, a typical trade means buying a position, holding it for one week, then selling it. For volume, we chose $2,000 for stocks and $20,000 for the currency trade.

The resulting catch-all benchmark includes spreads, commissions and financing costs for all brokers.

Now, let's see the verdict. Zerodha has super low stock and currency futures fees.

| Zerodha | Sharekhan | Interactive Brokers | |

|---|---|---|---|

| Indian stock | $0.0 | $4.00 | $0.20 |

| USDINR benchmark fee | $0.5 | $4.0 | - |

| Brokerage charge | Securities/Commodities transaction tax | Transaction/Clearing charges | Stamp charges | GST | SEBI charges | |

|---|---|---|---|---|---|---|

| Equity delivery | None | 0.1% on buy and sell | NSE: 0.00325%/trade BSE: 0.003%/trade |

0.015% or ₹1500 / crore on buy side | 18% of the brokerage and transaction charges | INR 5 / crore |

| Equity intraday | 0.03% or Rs. 20/executed order, whichever is lower | 0.025% on sell | NSE: 0.00325%/trade BSE: 0.003%/trade |

0.003% or ₹300 / crore on buy side | ||

| Equity futures | 0.03% or Rs. 20/executed order, whichever is lower | 0.01% on sell | NSE: 0.0019%/trade | 0.002% or ₹200 / crore on buy side | ||

| Equity options | Flat Rs. 20 per executed order | 0.05% on sell | NSE: 0.05%/trade | 0.003% or ₹300 / crore on buy side | ||

| Currency futures | 0.03% or Rs. 20/executed order, whichever is lower | No STT fee | NSE: 0.0009%/trade BSE: 0.00022%/trade |

0.0001% or ₹10 / crore on buy side | ||

| Currency options | 0.03% or Rs. 20/executed order, whichever is lower | No STT fee | NSE: 0.035%/trade BSE: 0.001%/trade |

0.0001% or ₹10 / crore on buy side | ||

| Commodity options | 0.03% or Rs. 20/executed order, whichever is lower | 0.01% on sell | Ranges between 0.0005% to 0.001%/trade | 0.002% or ₹200 / crore on buy side | ||

| Commodity futures | 0.03% or Rs. 20/executed order, whichever is lower | 0.05% on sell | No fees | 0.003% or ₹300 / crore on buy side |

No inactivity fee, no withdrawal fee

While the broker charges no inactivity fee and withdrawal fee, there is an account fee.

The account fee is INR 300 + 18% tax per year for Demat accounts and INR 1,000 + 18% tax per year for corporate accounts. If you open a commodity account, you will be charged INR 100 + 18% tax per year.

| Broker | Inactivity fee | Withdrawal fee |

|---|---|---|

| Zerodha | $0 | |

| Sharekhan | $0 | |

| Interactive Brokers | $0 |

Check out a detailed analysis of all the fees, commissions, and other charges levied by Zerodha for more information.

Safety

- Majority of clients belong to a top-tier financial authority

Deposit and withdrawal

- Free withdrawal

- No deposit fee

- User-friendly

Account opening

- No minimum deposit

Mobile app

- User-friendly

- Good variety of order types

- Price alerts

Web trading platform

- User-friendly

- Clear fee report

- Good search function

Product selection

FAQ

Everything you find on BrokerChooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology.