Why choose XM

XM is a global forex and CFD broker regulated by Australia's ASIC, CySEC of Cyprus, and the Belize authority IFSC.

XM has low stock index CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account.

On the other hand, XM has a limited product portfolio as it offers mainly CFDs and forex trading and its forex and stock CFD fees are average.

BrokerChooser gave XM a 4.2/5 rating based on analyzing 600+ criteria and testing via opening a live account.

- Low stock index CFD and withdrawal fees

- Easy and fast account opening

- Great educational tools

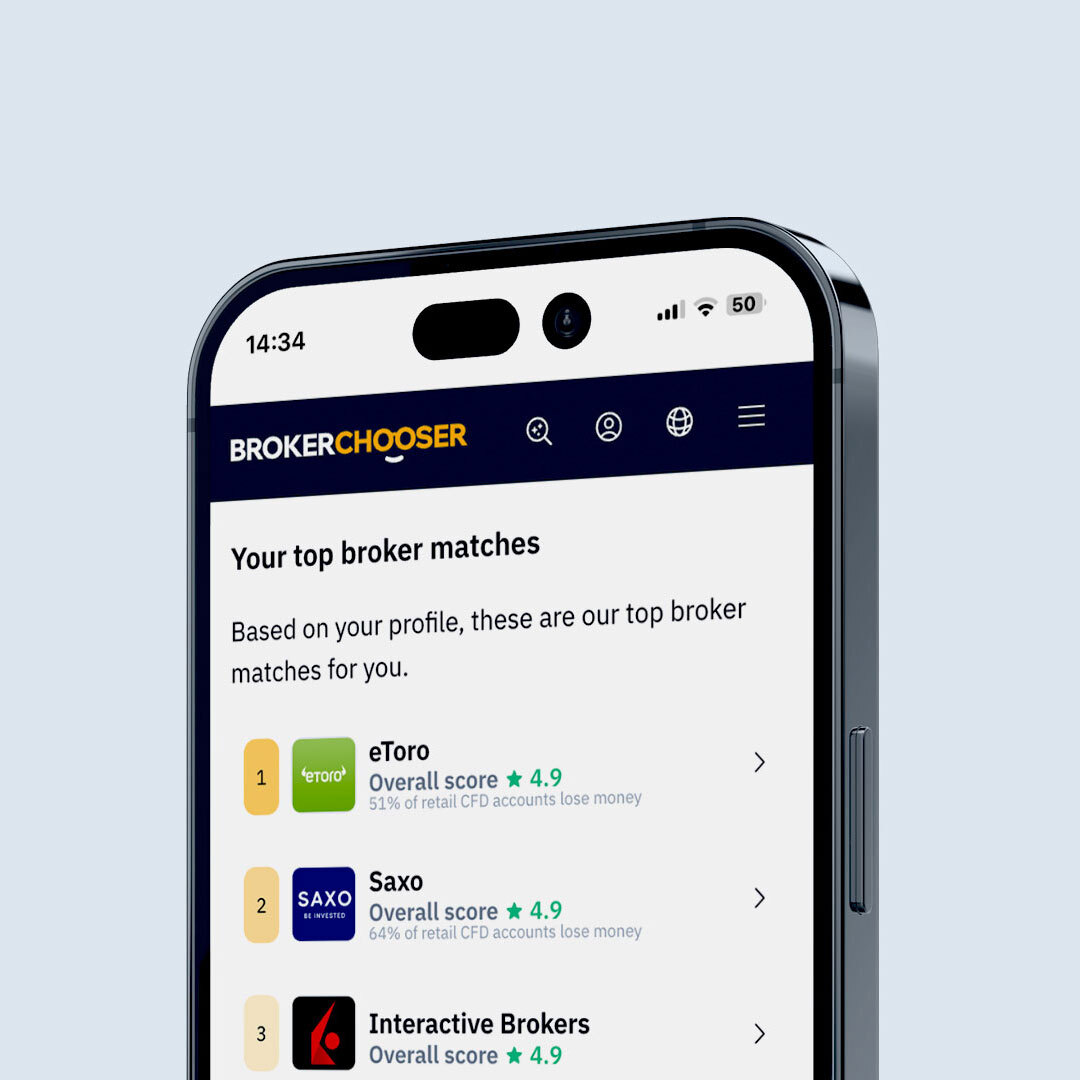

Not sure if this is the right broker for you? See the best ones.

See how the best brokers compare to XM

Fees

- No withdrawal fee

- Low stock index CFD fees

We compared XM's fees with two similar brokers we selected, FxPro and Admirals (Admiral Markets). These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. See a more detailed comparison of XM alternatives.

Low FX fees

XM charges a forex commmission: $3.50 commission per lot per trade on XM Zero accounts. Spread costs come on top of this, e.g. the EUR/USD spread is 0.1.

| Broker | EURUSD spread | FX commission per lot |

|---|---|---|

| XM | 0.1 | $3.50 commission per lot per trade on XM Zero accounts |

| FxPro | 1.4 | No commission is charged |

| Admirals (Admiral Markets) | 0.1 | $3.00 commission per lot per trade |

Low index CFD fees

All index CFD fees are built into the spread. For example, the spread for S&P 500 index CFDs is 0.6.

| Broker | S&P 500 CFD spread |

|---|---|

| XM | 0.6 |

| FxPro | 1.0 |

| Admirals (Admiral Markets) | 0.4 |

Average stock CFD fees

All stock CFD fees are built into the spread. The spread for Apple stock CFDs, for example, is 0.4.

| Broker | Apple CFD |

|---|---|

| XM | $1.5 |

| FxPro | $1.6 |

| Admirals (Admiral Markets) | $1.1 |

Low inactivity fee, no withdrawal fee

There is no account fee and XM charges no withdrawal fee in most cases, though bank withdrawals below $200 carry a $15 fee.

There is a $15 one-off maintenance fee after 1 year of inactivity, and this is followed by a $5 monthly fee if the account remains inactive.

| Broker | Inactivity fee | Withdrawal fee |

|---|---|---|

| XM | $0 | |

| FxPro | $0 | |

| Admirals (Admiral Markets) | $0 |

Other commissions and fees

:Low real stock commission: Trading US stocks at XM comes with the following commissions - $1.0.

| Broker | US stock | UK stock |

|---|---|---|

| XM | $1.0 | $9.0 |

| FxPro | - | - |

| Admirals (Admiral Markets) | $0.0 | $0.0 |

Check out a detailed analysis of all the fees, commissions, and other charges levied by XM for more information.

Safety

- Negative balance protection

- Regulated by the top-tier ASIC

Deposit and withdrawal

- Credit/Debit card available

- Several account base currencies

- Free wire withdrawal above $200

Account opening

- Fast

- Fully digital

- Low minimum deposit

Mobile app

- User-friendly

- Good search function

- Price alerts

Desktop platform

- Clear fee report

- Good customizability (for charts, workspace)

- Price alerts

Product selection

FAQ

Everything you find on BrokerChooser is based on reliable data and unbiased information. We combine our 10+ years finance experience with readers feedback. Read more about our methodology.